A Budget That Finally Makes Sense

Build a Flexible, No-Shame Budget in Just 30 Days Even If You Feel Totally Behind

You deserve to feel confident with your money. This guide shows you how to create a system that actually sticks—without apps, spreadsheets, or strict rules that never worked for your life.

“I feel like budgeting is something I’m just not wired to understand.”

Let me guess—

You’ve downloaded the budgeting apps.

Tried color-coded spreadsheets.

Set "spending limits" that lasted about 4 days.

And somehow… your money still disappears.

You’re not lazy.

You’re not bad with money.

You’re just missing a system that fits your real life.

Here’s what my money life used to look like:

Feeling scared to even check my account balance

Forgetting what subscriptions I’m still paying for

Buying random stuff “just this once” and regretting it later

Dreading bill due dates because I forgot to plan

Wondering why I’m broke even when I don’t think I spend that much

I Tried Everything “Experts” Recommended:

Budgeting apps (only used them for 2 weeks before giving up)

Tracking every penny in Excel (numbers never matched my bank account)

Separate bank accounts for each expense (confusing and exhausting)

Cash envelope system (didn’t work with online shopping)

Giving myself a weekly allowance (broke it almost immediately)

And it always ended the same way: I gave up and felt like a failure.

Then I Discovered Something That Changed Everything...

Out of frustration, I started building a system that worked for how I think—not what finance bros on YouTube say works.

Here’s what I found:

According to Forbes, over 60% of young adults don’t track where their money goes—and most say it makes them anxious.

Here’s what shocked me:

Budgeting isn’t about being strict—it’s about clarity

You don’t need to “cut out coffee,” you need to prioritize

Most people were simply never taught how to do this effectively

And after helping over 200 adults do the same, I turned it into a guide:

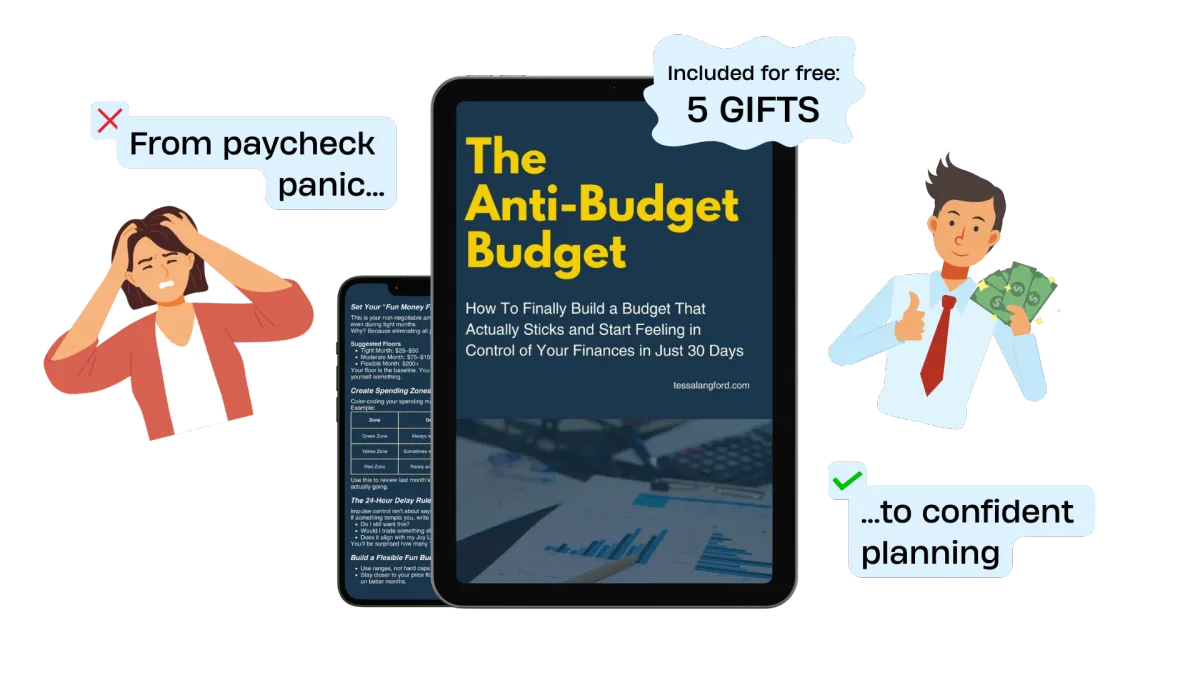

Introducing: The Anti-Budget Budget

By starting with what you actually spend (not what you “should” spend), I was able to:

Finally track my money without confusion

Pay off lingering credit cards

Start saving automatically

Understand my financial patterns

Feel in control for the first time ever

The Transformation You Can Expect

Don’t let money confusion keep controlling your confidence.

You can feel proud of your finances—it just takes the right system.

Before The Anti-Budget Budget:

Constant financial anxiety

Random untracked purchases

Guilt after every splurge

Overwhelmed by spreadsheets and apps

“Budgeting” means feeling broke

No clue where to even start

After The Anti-Budget Budget:

Total clarity on where your money goes

Confidence to spend on what matters

A routine you can stick with

Easy check-ins (5 minutes a week!)

Debt paid down, savings going up

Finally feeling like a real adult with a plan

INSTANT ACCESS – Start Fixing Your Finances Today

Here’s Everything You Get With The Anti-Budget Budget Today:

What's included:

The Full 5-Part Anti-Budget Budget Guide: A brain-friendly method that helps you build a sustainable, customizable, real-life-proof budget.

Plus These 5 Targeted Bonuses

“Fix My Subscriptions” Tracker – Finally identify and cancel the charges draining your bank account

“Where Did My Money Go?” Workbook – Walkthrough to pinpoint where you’re leaking cash

“Guilt-Free Fun Money Plan” – How to enjoy life and stay on track financially

“I Blew My Budget—Now What?” Reset Kit – Bounce back without spiraling or starting over

“The 30-Day Budget Habits Builder” – Build routines that actually stick without using 10 apps

Normally: $79

Today: $29

YOUR FINANCIAL RESET STARTS HERE

The 5 Core Components That Transform Confusion Into Control:

1. “Start Where You Are” Budget Map (Week 1)

Finally see where your money is going—without shame

Understand your spending habits with total honesty

Start with a no-shame, no-stress budget ma

2. The Cash Flow Decoder (Week 2)

Know when money is coming in vs going out

Set up flexible categories that adjust

What to do when you overspend

3. The Guilt-Free Spending Formula (Week 3)

Create your “Fun Money Floor”

Enjoy life without blowing your goals

Never feel broke after payday again

4. The Habit-Lock Toolkit (Week 4)

5-minute weekly check-in routine

The No-App Auto Tracker

Bounce back after budget setbacks

5. The Flexible Future Blueprint (Bonus Module)

Start saving even if you’re in debt

Plan for changes in income

Build a budget that grows with you

Stop Feeling Like You’re Failing With Money

Get The Anti-Budget Budget Now

While others are still stuck on budgeting apps that don’t work, you’ll be building a real plan that actually fits your life!

Real People, Real Results

Jake, 49

“For the first time in my adult life, I feel like I’m in control of my money. This guide didn’t just help me budget — it helped me breathe easier.”

Monica, 44

“I’m a mom of three with irregular income. This was the first system that didn’t make me feel ashamed or behind. It fits my real life.”

Carla, 38

“Within the first 15 minutes, I found over $78 in charges I didn’t realize I was still paying.”

STILL NOT SURE?

My Personal Promise To You

If you’ve ever felt like budgeting just “isn’t for you” or like you’re too disorganized to stick with it—you are exactly who this was made for.

This guide was created after hundreds of hours of research, testing, and real-life failure, so you don’t have to start from scratch. I know what it’s like to feel like you’re behind, embarrassed, or confused about money—and I built this to help you get unstuck.

Try it out for 30 days. If you don’t feel more confident and more in control of your finances, just email me for a full refund. No awkwardness. No hoops. Just real support.

Still got questions?

Frequently Asked Questions

What exactly do I get?

You get the full Anti-Budget Budget guide PDF plus 5 printable bonus tools delivered instantly via email.

What if I'm not good with numbers?

This system is made for real people, not math pros. No complicated formulas. Just clear, brain-friendly steps.

What if I’m already in debt?

You don’t need a perfect financial situation to start. This guide was built for people getting back on track—it meets you where you are.

Will I need special software or budgeting apps?

No apps required. You can use paper, a Google Doc, your Notes app, or the included trackers. It works with your lifestyle.

What if I don’t have a steady income?

The system is built to be flexible. Whether your income is weekly, monthly, seasonal, or varies, you’ll learn how to work with it instead of against it.

What makes this different from other budgeting guides?

Most systems start with rules. This starts with you. The Anti-Budget Budget was built to fit real-life messiness, not some perfect version of your finances.

Your Financial Reset Starts Here

You don’t need another budgeting app. You need a system built for your life, not someone else’s.

Let this be the moment where everything starts to click.

COPYRIGHT 2025 | TESSALANGFORD.COM | PRIVACY POLICY | TERMS & CONDITIONS

DISCLAIMER: Please understand results are not typical. Your results will vary and depend on many factors including but not limited to your background, experience, and commitment level. All [NICHE TERM] entails risk as well as consistent effort and action.

NOT FACEBOOK: This site is not a part of the Facebook™ website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook™ in any way. FACEBOOK is a trademark of FACEBOOK, Inc. DISCLAIMER: Please understand results are not typical. Your results will vary and depend on many factors including but not limited to your background, experience, and work ethic. All business entails risk as well as taking regular and consistent effort and action.

Nothing on this page, any of our websites, or any of our content or curriculum is a promise or guarantee of results or future results, and we do not offer any legal, medical, tax or other professional advice. Any potential results referenced here, or on any of our sites, are illustrative of concepts only and should not be considered average results, exact results, or promises for actual or future performance. Use caution and always consult your accountant, lawyer or professional advisor before acting on this or any information related to a lifestyle change or your business or finances. You alone are responsible and accountable for your decisions, actions and results in life, and by your registration here you agree not to attempt to hold us liable for your decisions, actions or results, at any time, under any circumstance.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.